One Person Company

Registration

Quick CA Services offers seamless One Person Company (OPC) registration, guiding you through the process efficiently. Establish your OPC effortlessly with expert assistance!

Talk to our expert:

TALK TO OUR EXPERT

What is One Person Company (OPC): Benefits and Registration Process

In the dynamic landscape of business, the concept of a One Person Company (OPC) has gained significant traction. This unique business structure is designed to provide a platform for solo entrepreneurs, combining the benefits of limited liability with the ease of operation.

Let’s delve into the intricacies of OPC and explore why it has become a popular choice among individuals looking to embark on their entrepreneurial journey.

Before you decide to register a one-person company (OPC), it’s important to know the rules and limits for creating it. The Companies Act has specific conditions that need to be followed to make sure the person starting the OPC is allowed to do so.

Eligibility Criteria of One Person Company (OPC)

To set up a One Person Company (OPC) in simple terms:

Who Can Start an OPC: Only an individual who is an Indian citizen can start an OPC. Companies or LLPs cannot create an OPC.

Residency Requirement: The person starting the OPC must be a resident of India, meaning they should have lived in India for at least 182 days in the previous calendar year.

Minimum Money Needed: The OPC needs a minimum authorized capital of Rs 1,00,000, which is the amount mentioned during registration.

Nominee Needed: The person starting the OPC must choose a nominee during registration. This nominee would take over if the person is unable to run the OPC due to death or incapacity.

Certain Businesses Not Allowed: OPCs cannot engage in financial activities like banking, insurance, or investments.

Conversion Rules: If the OPC’s money or turnover exceeds certain limits, it must be converted into a private limited company to follow the rules for larger companies.

- One OPC per Person: An individual can start only one OPC, and an OPC cannot have a minor as a member.

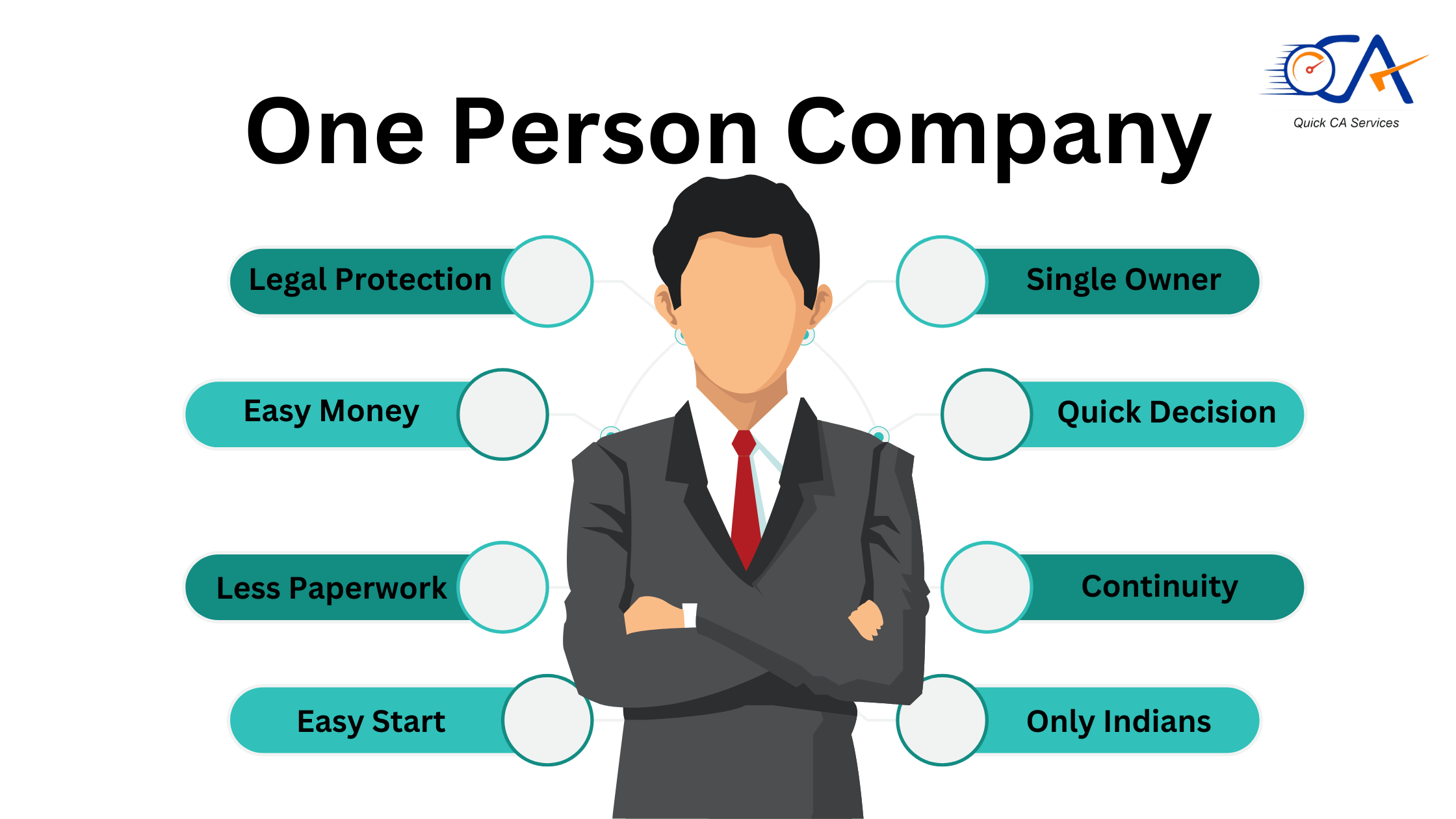

Benefits of One Person Company (OPC)

Legal Protection: An OPC has its own legal identity, which protects the person who started it from being personally responsible for company debts.

Easy Money: OPCs, being private companies, find it easy to get money from investors and banks compared to individual businesses.

Less Paperwork: OPCs have some exemptions from following all the rules in the Companies Act, 2013, making administrative work simpler.

Easy Start: OPCs can start with just one person and one backup, with the person also being the boss. There’s no need for a minimum amount of money to start.

Quick Decision-Making: With one person in charge, decisions can be made quickly, making the company run efficiently without conflicts or delays.

Continuity: OPCs keep going even if there’s only one member, ensuring the company continues to exist.

OPCs have several benefits, including limited personal responsibility, easy fundraising, less paperwork, simple start-up and management, and ongoing existence.

Registration Process of One Person Company (OPC)

In India, registering a One Person Company (OPC) is done using the SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) form. This new form replaces the old ones used for company registration.

The OPC registration happens in two parts:

Part A: This is the first part of the SPICe+ form. It’s about getting approval for the company name you want and applying for the Director Identification Number (DIN) or Permanent Account Number (PAN) for the person who will be the director.

Part B: The next part, called Part B, is where you give the details needed for the incorporation. This includes the OPC’s registered office address, information about the money the company will have (share capital), details about the director, and info about the shareholder.

These are the steps for registering an OPC.

Step 1: Get a Digital Signature Certificate (DSC)

Get a special electronic signature for the person who will run your company. This signature is needed for signing important online documents.

Step 2: Get Director Identification Number (DIN)

Get a unique number for the person who will be the director of the Ministry of Corporate Affairs.

Step 3: Choose a Unique Name

Pick a name for your company and apply to reserve it on the MCA website. Make sure it’s a unique name that doesn’t already belong to another company.

Step 4: Create Company Rules

Write down the goals and rules for your company in two documents called Memorandum of Association (MOA) and Articles of Association (AOA).

Step 5: Submit Forms

Send the necessary forms and documents to the MCA for OPC registration. Include things like MOA, AOA, proofs, and declarations.

Step 6: Get a Certificate

Once the Registrar of Companies approves everything and checks that you followed the rules, they’ll give you a Certificate of Incorporation. This certificate shows that your One Person Company is officially registered, and it includes important numbers for taxes.

Now, with this certificate, your OPC is recognized, and can start doing business in India.

Why Quick CA Services for OPC Registration?

Quick CA Services is the best partner for One Person Company (OPC) registration for several compelling reasons. With years of expertise in company registration and a deep understanding of the regulatory landscape.

Quick CA Services makes the OPC registration process easy. We provide expert assistance, helping you with everything from reserving your company name to preparing and submitting the required documents. We are dedicated to ensuring accuracy and compliance in your OPC registration, making sure it meets all legal requirements.

Our committed support team is always available to assist with any questions or concerns you may have.

One Person Company offers a unique avenue for solo entrepreneurs to establish and operate their businesses with limited liability and enhanced control.

Aspiring entrepreneurs should carefully weigh the advantages and challenges, considering their specific goals and aspirations. The OPC structure, when navigated correctly, can pave the way for remarkable success in the business world.

One Person Company (OPC) FAQs

How can I register as an OPC?

To register as an OPC, ensure you meet the eligibility criteria, gather the necessary documents, and follow the step-by-step registration process outlined by regulatory authorities.

What advantages does an OPC offer over a sole proprietorship?

OPC provides limited liability, making it a more secure option for entrepreneurs. Additionally, it allows for easier access to funding and presents a more professional image.

Is there a limit to the turnover an OPC can achieve?

There is no specific turnover limit for OPCs, allowing them to scale their operations without restrictions.

Can I appoint a nominee for my OPC?

Yes, as per regulations, every OPC must appoint a nominee who will take over in case of the owner’s incapacitation.

How often do I need to conduct meetings for my OPC?

OPCs are required to conduct at least one board meeting in each half of the calendar year. Compliance with such meetings is vital for maintaining legal status.